Résumé

Des taxes d'aviation bien conçues peuvent générer des recettes prévisibles pour le financement de la lutte contre le changement climatique et du développement, tout en renforçant l'équité et la solidarité. Les preuves sont claires : les sièges en classe affaires et en première classe peuvent tripler l'empreinte d'un billet en classe économique, tandis que les jets privés émettent jusqu'à 14 fois plus par passager-kilomètre que les avions commerciaux, ce qui justifie que l'on se concentre sur les voyageurs haut de gamme.

L'aviation est l'une des sources d'émissions les plus inégales au monde : une infime minorité de grands voyageurs et de propriétaires de jets privés génère une part stupéfiante des dommages climatiques, alors que la plupart des gens ne mettent jamais les pieds dans un avion. Pourtant, cette pollution de luxe n'est toujours pas taxée, protégée par des exemptions obsolètes et des subventions implicites.

Le résultat est un secteur à forte intensité de carbone traité comme s'il était hors de portée d'une fiscalité équitable.

Le présent manuel juridique propose une voie pratique vers le changement. Il propose deux mesures ciblées qui sont techniquement réalisables, politiquement défendables et conformes au droit international :

- les prélèvements sur les voyages aériens haut de gamme et

- les taxes sur le carburant des avions privés.

"Une infime minorité de grands voyageurs et de propriétaires de jets privés est à l'origine d'une part considérable des dommages climatiques.

Ces mesures sont fondées sur le principe du pollueur-payeur et s'alignent sur les normes d'équité fiscale. Elles font porter la responsabilité non pas sur les voyageurs ordinaires, mais sur ceux qui sont les plus à même de contribuer - et les plus responsables d'émissions disproportionnées.

Ces mesures ne sont pas spéculatives. De nombreux pays appliquent déjà diverses formes de prélèvements sur les billets d'avion et de taxes sur le carburant, dont la conception résiste à l'examen juridique et commercial international. L'analyse juridique et les pratiques existantes confirment leur compatibilité avec la convention de Chicago, les accords sur les services aériens (ASA), le droit de l'OMC et le droit de l'Union européenne (UE).

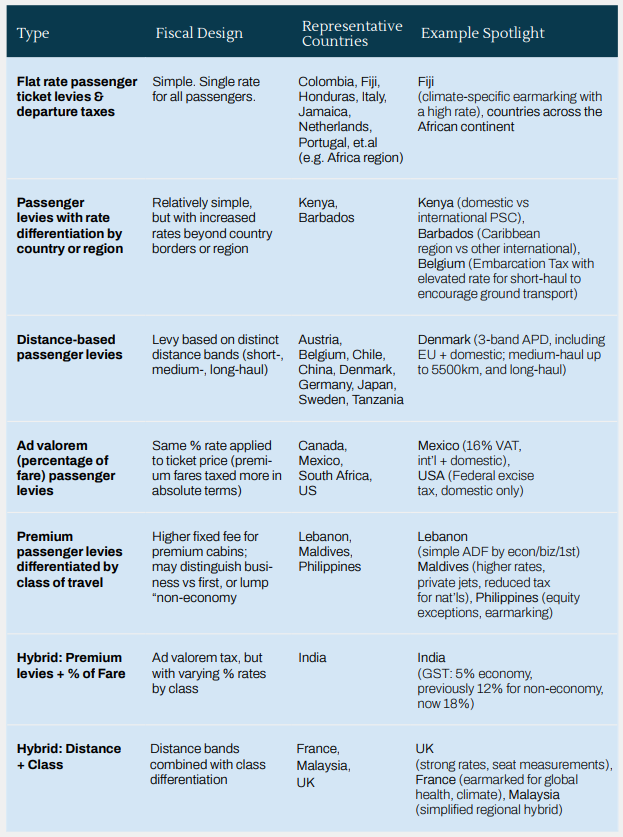

La cartographie comparative présentée ici - y compris la mise en œuvre par la Barbade, la Belgique, le Danemark, la France, l'Allemagne, l'Inde, le Kenya, le Liban, la Malaisie, les Maldives, le Mexique, les Philippines, le Royaume-Uni et d'autres pays - montre l'éventail des modèles réalisables.

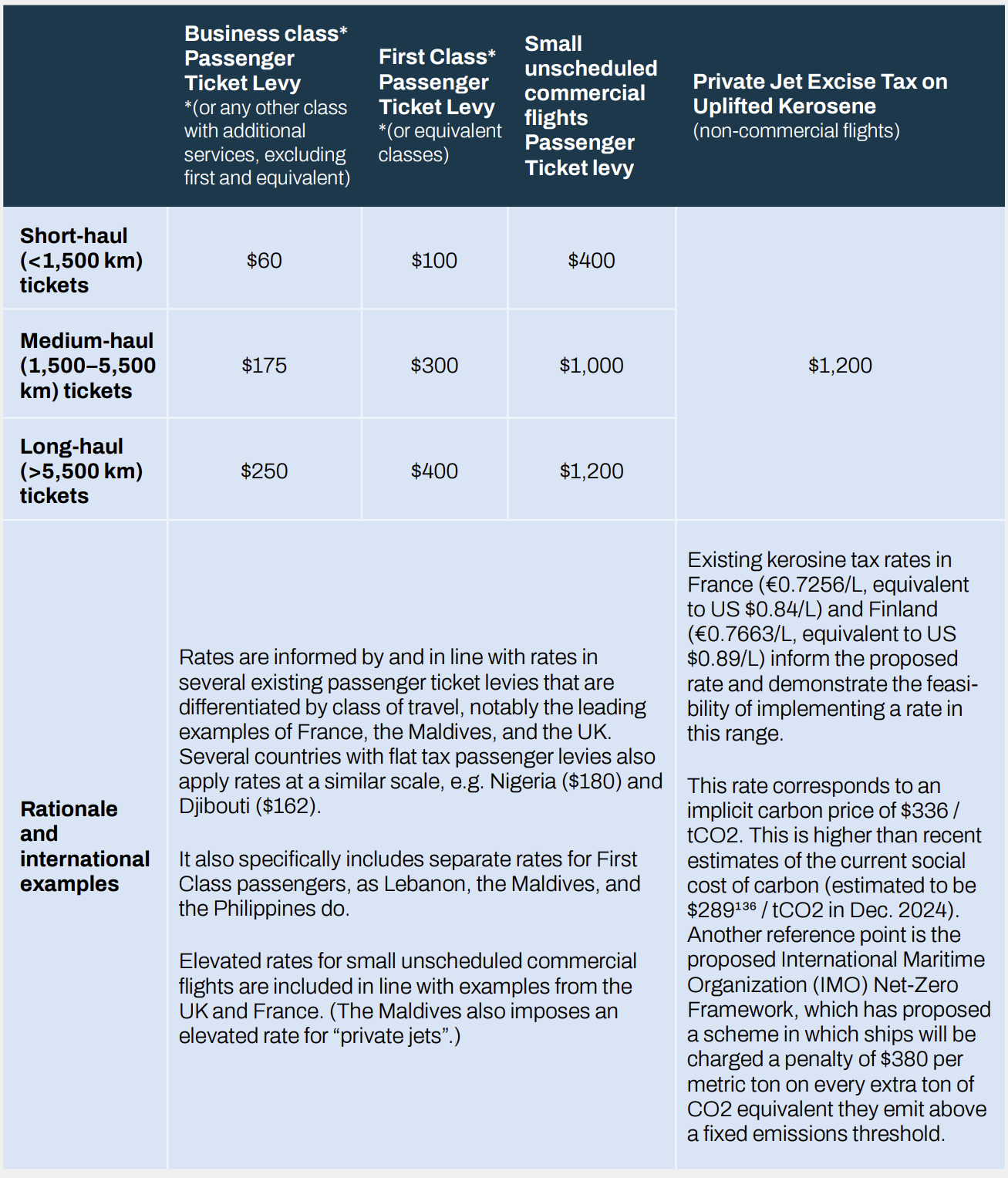

Le guide de rédaction fournit ensuite un texte législatif prêt à l'emploi pour les gouvernements désireux d'agir rapidement, en mettant l'accent sur les taxes sur les billets d'avion de première classe, différenciées par classe et par tranche de distance, et sur les droits d'accise sur le kérosène revalorisé pour les jets privés.

Le moment politique est venu. La COP30 de Belém offre aux gouvernements la possibilité de prouver que la solidarité climatique est plus qu'une simple rhétorique. Plus qu'un manuel technique, il s'agit d'une invitation à agir. En adoptant cette année des taxes aériennes équitables et progressives dans le cadre d'une coalition internationale de volontaires, les gouvernements peuvent contribuer à combler le fossé entre l'ambition climatique et le financement, tout en corrigeant l'une des inégalités les plus criantes en matière d'émissions mondiales.

Introduction et contexte

L'aviation est l'une des formes de transport les plus intensives en carbone, mais ses émissions sont concentrées dans une proportion relativement faible de personnes à hauts revenus, de grands voyageurs et d'utilisateurs de jets privés. Il est techniquement possible de remédier à ce déséquilibre par des prélèvements ciblés, en conformité avec le droit international, et politiquement opportun, puisque les gouvernements recherchent des mécanismes nouveaux et équitables pour mobiliser des fonds pour le climat lors de la COP30 et au-delà.

Le groupe de travail sur les taxes de solidarité mondiale : For People and the Planet (GSLTF) a été lancée lors de la COP28 en 2023 pour explorer des mesures fiscales progressives qui génèrent des revenus prévisibles pour le climat et le développement, tout en décourageant idéalement les émissions de gaz à effet de serre.

À la suite de consultations avec les gouvernements, les experts et la société civile au début de l'année 2025, le GSLTF a identifié les taxes sur les voyages aériens haut de gamme et le kérosène privé comme faisant partie des mesures les plus susceptibles d'être adoptées par plusieurs pays d'ici à la COP30 en novembre 2025.

Ces mesures visent à promouvoir trois objectifs interdépendants :

- Générer des recettes nouvelles et prévisibles pour le financement de la lutte contre le changement climatique et le développement,

- Aligner la charge fiscale sur la capacité à payer et la contribution à l'impact climatique, et

- Encourager le passage à des formes de transport moins polluantes,

Préparé pour le compte du secrétariat de la GSLTF, ce manuel juridique

vise à fournir aux gouvernements une base pratique pour la négociation d'accords de libre-échange.

et la mise en œuvre de prélèvements progressifs, coordonnés au niveau international, sur les

les voyages aériens haut de gamme et le carburant pour l'aviation privée.

Plus précisément, le manuel juridique est destiné à :

Le manuel juridique présente l'expérience comparative en matière de taxation de l'aviation à partir des pratiques nationales, des cadres juridiques internationaux et des récentes innovations fiscales liées au climat.

Ensemble, ces éléments offrent aux gouvernements la possibilité de parvenir à un consensus lors de la COP30 et de traduire leurs engagements en actions.

Faisabilité globale des taxes sur l'aviation

L'examen juridique de la Convention de Chicago, de l'OMC/GATS, des accords sur les services aériens (ASA) et du droit communautaire montre que les taxes différenciées sur les passagers et les taxes sur le kérosène des jets privés sont juridiquement possibles dans les cadres internationaux et nationaux existants. Chaque corpus juridique fixe certaines limites, mais aucune n'exclut les modèles de prélèvements étudiés dans la section suivante de ce manuel juridique.

Les taxes basées sur les passagers, y compris celles qui sont différenciées par classe ou par distance, sont bien établies dans de nombreuses juridictions. Ils ne sont pas en conflit avec l'art. 15 de la Convention de Chicago, à condition qu'elles soient appliquées de manière uniforme et transparente. Les taxes sur les carburants peuvent être plus limitées par les exemptions accordées par l'ASA aux transporteurs commerciaux internationaux, mais les vols en jet privé et le transport aérien intérieur restent dans la marge de manœuvre des États.

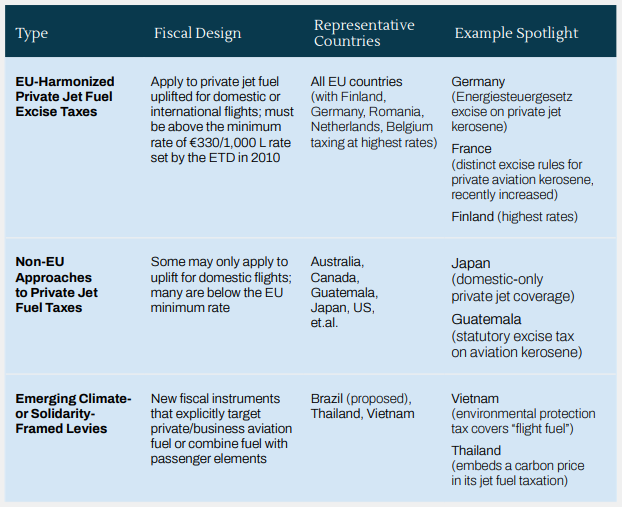

Au niveau de l'UE, la directive sur le transport aérien consacre l'exonération fiscale du kérosène destiné à l'aviation commerciale, mais exclut explicitement de cette exonération la taxation du carburant destiné à l'"aviation de tourisme privée". Les États peuvent également imposer des prélèvements non discriminatoires sur les passagers et des redevances aéroportuaires, à condition que les principes des traités de l'UE soient respectés.

Les règles de l'OMC n'imposent que des exigences générales de non-discrimination (NPF et traitement national), auxquelles les redevances passagers et les taxes sur le kérosène peuvent satisfaire si elles sont structurées de manière à éviter les distinctions fondées sur la nationalité.

Dans l'ensemble, le test de faisabilité est réussi pour les deux types de taxes sur l'aviation, à condition que les États s'en assurent :

La faisabilité juridique de ces mesures est donc forte et les gouvernements ont le pouvoir d'aller de l'avant sans attendre une nouvelle loi internationale.

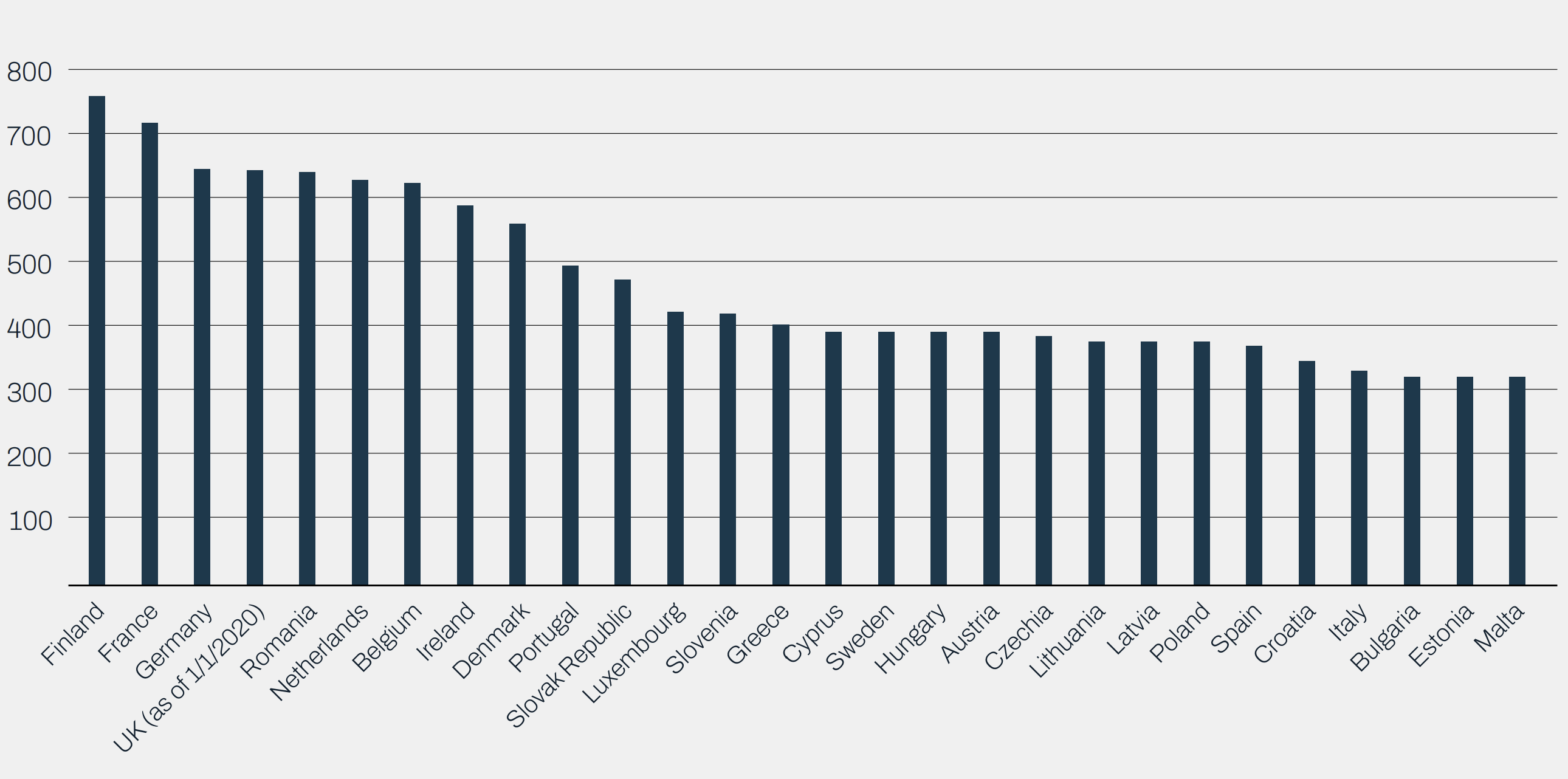

Taxes d'accise sur le kérosène pour l'aviation privée dans l'UE (2025)

Taxonomie des redevances différenciées sur le transport aérien de passagers

Résumé des taxes sur le kérosène et le carburant des avions privés

Équité et différenciation

L'un des principes fondamentaux de la fiscalité internationale est que les mesures doivent être conçues de manière équitable, en conciliant la responsabilité climatique et les réalités du développement. Les taxes sur l'aviation sont particulièrement sensibles, car elles touchent à la fois à la justice climatique et à la souveraineté économique. Pour garantir l'équité, les rédacteurs peuvent incorporer des tranches basées sur la distance, des multiplicateurs de classe (classe affaires/première classe ou équivalents pour les classes/cabines autres que la classe économique), ou des substituts sensibles à la richesse (par exemple, des surtaxes plus élevées sur les départs de jets privés).

De nombreuses juridictions exemptent certaines catégories de passagers pour des raisons humanitaires, médicales ou diplomatiques, afin de s'assurer que la taxe ne pèse pas de manière disproportionnée sur les groupes vulnérables. Lorsque les objectifs de solidarité sont essentiels, les rédacteurs peuvent explicitement affecter les recettes à des fonds climatiques internationaux ou à des mesures d'adaptation, inscrivant ainsi l'équité dans la loi elle-même.

Pour les petits États insulaires en développement (PEID), les pays les moins avancés (PMA) et les régions reculées, la connectivité aérienne est souvent une bouée de sauvetage. Les exonérations ou les taux réduits pour les liaisons court-courriers et les liaisons vitales sont donc justifiés et compatibles avec les cadres d'équité climatique. Des précédents existent : la taxe britannique sur les passagers aériens prévoit des exonérations pour certains aéroports écossais, et la taxe de solidarité française exonère les vols médicaux et les vols de sauvetage. Les Maldives appliquent également des tarifs économiques réduits pour leurs ressortissants.

Les Fidji affectent les recettes à l'adaptation, ce qui montre que l'équité peut être obtenue à la fois par la différenciation des taux et par l'utilisation des recettes. En outre, on pourrait envisager d'appliquer des taux différenciés en fonction des groupes de revenus. Le FMI l'a déjà suggéré pour la tarification du carbone à l'échelle de l'économie (différenciation entre les prix du carbone pour les faibles revenus, les revenus moyens et les revenus élevés).

La progressivité peut également être intégrée dans la conception de la taxe. Les passagers de première classe et les utilisateurs de jets privés - généralement les plus riches et les plus gros émetteurs - peuvent supporter des redevances plus élevées par passager ou par litre sans risque important de fuite.

Résumé des taux modèles des taxes aéronautiques prioritaires

Ce qui suit est un résumé des deux principaux types de taxes aéronautiques prioritaires discutées dans le document suivant

le présent manuel juridique, ainsi que les taux types

Avocats

Clémentine Baldon

Associé fondateur et directeur de Baldon Avocats et expert juridique pour le Secrétariat

Daniel Mulé